Shy AND Retiring? Don’t Think So…

Headline: Shy AND retiring? Don’t think so..

Date: 12/9/2020

Body: I was at my full-time job working at the IRS, and I came across an article on a pilot study they are doing concerning Phased Retirement. ( I regret that I cannot insert a link to the source material, but I legally cannot.) I thought this concept was important enough that it should be addressed in a post.

What is Phased Retirement?

A phased retirement is simply a way to ease into retirement. This might include a decrease in work hours, working only certain days in the work week, or seasonal work only. (It is important to note that this type of “program” can be either formal or informal.) It is a help to the retiree because they derive satisfaction from the work and benefit from the social interaction. The cash doesn’t hurt either. But, the employer also benefits because there is not that sudden “brain drain” that so many employers have to cope with. Often, a portion of this arrangement is a “knowledge transfer” mechanism where the senior will coach junior employees. Per the IRS, there are some income limits before Social Security is affected (just over $18,000), but changes in Social Security have made it easier for many Americans to work after reaching full retirement age.

How common is it to find a phased retirement program at a workplace?

It is becoming more common, and since the pandemic is making many people work from home, I can’t help but believe that it might become even more common. In 2016, the TransAmerica Center for Retirement Studies completed a study of 1,800 workplaces and reported that 40% of the employers had some type of program to support the concept of phased retirement. Given the size of the Baby Boom generation, we need to mitigate this potential loss of knowledge within the workplace.

In a personal example, my father worked for an engineering firm that didn’t have this type of program. He developed symptoms of a degenerative disease, and spoke with management. He devised a schedule where he worked Monday, Tuesday, Thursday and Friday, so that he would only have to work 2 days sequentially before he could take time off to rest and recuperate. He worked an 80% schedule and received 80% of his salary, and continued this informally-organized pattern for several years.

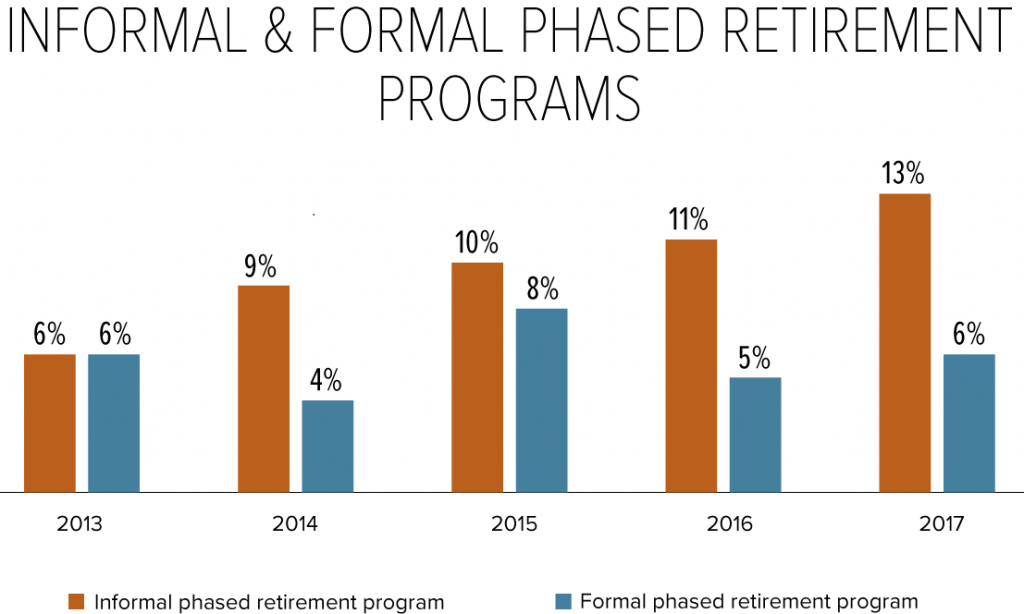

Per the Society for Human Resource Management (SHRM) the number of formal programs are small, but the number of informal programs have been increasing. This pattern discovered by SHRM are echoed by a variety of other experts too. “We’re finding that informal arrangements exist at almost every employer, but formal programs are rare,” says Steve Vernon, a vice president at Watson Wyatt Worldwide. Other individual companies seem to recognize the need for this type of arrangement and make them a part of their employee retention programs. “We don’t have a specific program for phased retirement,” says Karen Fowler-Williams, vice president of employee relations and diversity at Lincoln Financial Group.. “It’s all within our regular flex program.”

Source: Society for Human Resource Management’s 2017 Employee Benefits survey report.

One researcher suggested that employers might prefer the informal approaches because they can offer the arrangement only to the highest-value employees. This would square with the story above as my father worked as an engineer for a defense contractor. When he began to work for this contractor, he brought with him an education from the US Naval Academy and MIT, along with an impressive career as an officer in the submarine service. Added to that, he was a gifted teacher, often helping out younger engineers. Given the work that this contractor did, and his personality, his experience was perfectly suited to his assignments. For these reasons, it made a lot of rational sense to be flexible enough to accommodate his medical needs.

Why don’t more employers offer a formalized plan?

To my reading, the reasoning turns out to be organization inertia, more than any other reasoning. Until recently, when a person started receiving pension distributions, they were given a gold watch, a hearty handshake, and a kick out the door. This might be a bit unfair to employers, who until recently had mainly defined-benefit pensions, and with these pensions, the regulations were extremely inflexible. Is it any wonder that the employers themselves were also inflexible? Now that defined contribution pensions are the norm, I believe that this situation will change, but for now, there is a large amount of inertia:

- Often, corporate policies will not allow for medical benefits to be given to less than full-time employees.

- IRS regulations still favor the defined benefit pension programs.

Until 2005, this inertia was very real, but, the Pension Protection Act of 2006 allows workers 62 and older to receive pension distributions while still working part time. So, there appears to be reasons to hope that a force might be applied to employers that will not allow them to “stay at rest.”

So, what is an older-employee to do?

In view of how uncommon formal programs are, the employees need to be assertive and begin the conversation with their managers. Said one expert:

“In the absence of a formal phased retirement program, then it’s up to the employee to initiate a conversation with the employer,” says Catherine Collinson, president of the Transamerica Center for Retirement Studies. “Set forth a proposal in terms of the value you are going to provide. Mentoring and training your successor can only help your case.”

If your employer uses your last few years of employment to set your pension benefits, it might be to your benefit to consider leaving the employer and becoming a consultant. With their long experience, older workers can make a good case for themselves with new organizations.

REFERENCES

https://www.investopedia.com/terms/p/phased-retirement.asp

https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/phased-retirement-challenges.aspx

https://www.monster.com/career-advice/article/benefits-and-drawbacks-of-phased-re

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.