The Working Group.

Headline: What is the “Working Group on Financial Markets?”

Date: 8/15/2022

Body: Ok, the background on this is that there is a current struggle within the U.S. Government; Agencies are battling to see who will have chief responsibility to regulate cryptocurrency. The IRS seems to want to just tax the transactions as a capital gain, when they see the currency one way. The CFTC wants to have more control over regulation. The SEC (the big dog on this block) wants their pound of flash too. (Sorry, bad cyber pun, won’t happen again.) The very serious point here is that not only does the right hand not know what the left hand is doing… in point of fact, the left hand is actively waving off the right hand. For this reason, the President convened a Working Group on Financial Markets, chiefly made of personnel from FDIC and OCC. (No, the other OCC. The non-motorcycle-riding one, as far as I know.) This group just released a report on stablecoins.

These stablecoins are considered “stable” because their value is tied to the value of the USD or a commodity such as gold. Said Secretary Yellen, “Stablecoins that are well-designed and subject to appropriate oversight have the potential to support beneficial payments options. But the absence of appropriate oversight presents risks to users and the broader system,” So, the working group put together a few recommendations. First, everybody remembers pictures of the Bank runs in the 1930s, there are copies in every history text to date. To ensure that this does not happen to stablecoin users, law should be written such that issuers have to be insured depository institutions. This would seem like a win for the little guy, AND the FDIC. Second, they were concerned with payment system risk. To address this, they called for new law to require digital custodians to have federal oversight, and allow issuers of stablecoins to require these custodians to pass pretty strict risk-management standards. (This sounds to me like a “stress test” administered by the private companies… personally, I am rather, err… umm… dubious about this.) Hope for the best here. The third set of concerns focused on systemic risk and concentration of economic power OK, let’s take some time to look at this complicated-looking requirement.

In essence, they want a few things:

- Issuers of stablecoins should not be economically entangled with any other commercial entity. This is important because if there is a too tight alliance, that one entity could artificially control that entire currency, regardless of market forces.

- There should be interoperability between and among stablecoins. This is important because, if you are invested in one stablecoin currency (let’s say, pegged to the dollar) but there is a large move in the currency market, you might want to convert to a currency pegged to the price of gold.

- Congress may consider other standards for custodial wallet providers. Ok, this is important too. First, they want Congress to limit the strength of association of the wallet providers with any other commercial entity. The reasoning is much the same as #1, If one entity gets to economically control a wallet provider, people could be wiped out instantly with the stroke of a pen (or stylus.) They also want to limit how much use of your data can be made by the wallet providers. Let’s face it: You are entrusting these companies with a LOT of data about your purchasing power, your purchasing patterns, even the charitable contributions that you make. This would be PLATINUM in the devious hands of marketers, and believe me, they are salivating over this right now. Congress wants to limit the amount of personal data that can be sold.

OK, in the next section of the report, they do a VERY governmental thing, and say that for the near future, the Financial Stability Oversight Council has to straighten out these thorny issues.

I give up, who is the Financial Stability Oversight Council?

Isn’t it interesting that “oversight” usually means mistake, unless you are speaking of lawmakers?

Sorry, got side-tracked there. Well, they certainly need help in the UX department of website development. (It is terribly difficult to read anything.) That aside, they are a very important group within the Treasury Department. Interestingly, the council seems to have authority to select non-bank entities for oversight. This is important, given how large the shadow banking industry is, and how quickly the definition of currency is changing. The Secretary of the treasury sits at the big seat, and the others include other federal and state regulators as well as an insurance expert appointed by the President. They are important to seeing potential financial changes first, and then working to ensure that they are regulated adequately. (Think of them as the high-beams of the financial vehicle’s headlights. They shine a light on issues in the future, then engineer solutions to manage them with existing regulation.) Interestingly, the Dodd-Frank Act further enabled them to enact risk-management standards on any Payment Clearing or Settlement activities. They are also empowered to recommend closer oversight by any number of federal agencies, over these “systemic” entities.

They are required to present to Congress, every year, an Annual Report on their activities, and upon request, do other presentations in front of Congress. In fact, large portions of the meetings are open to the public. (I only spend so much time here because it seems likely that the “intermediate future” as enunciated by Congress could be a lot longer than we anticipate. So, these committee members are VERY important to the regulation of cryptocurrency.)

Are they concerned about anything other than fairness within the market?

Yes. Namely, the regulators are concerned that stablecoins could be used in an attempt to launder money. To combat this, the Treasury Department has the Financial Action Task Force looking at these money laundering issues and working with international partners to make things harder on the cybercriminals.

The Verdict

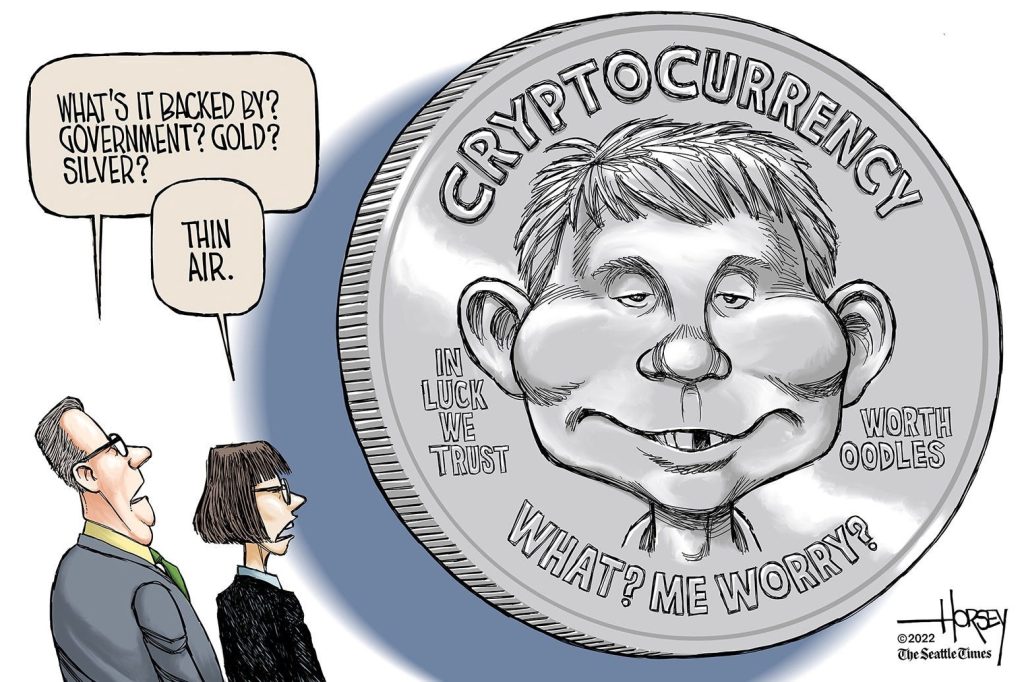

Reports of government instituted “Working Groups” are rarely spell-binding reads. But, they are important to understand if you wish to be an informed citizen. I think we should probably float the feds a little credit here, because we are all dealing with extremely new areas of finance here. When mutual funds started up, it took government a little bit of time to learn how to regulate them. And these were holding normal stocks and bonds. Cryptocurrency wallets hold substantially nothing, but a stake in a very high-stakes experiment in behavioral finance. It seems prudent that rule-makers be deliberate.

REFERENCES

https://home.treasury.gov/news/press-releases/jy0454

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.