Coins of the Realm(s?)

Headline: What is an ICO?

Date: 2/11/2022

Body: I have been reading a bit about cryptocurrency, and I keep seeing references to ICO. At first, I thought that it was an homage to the song from the 80s, then I learned that it stood for “Initial Coin Offering.” (ICO). These events appear to be happening much more frequently than countries being added to the globe, so I have to admit; I was a bit stumped. Maybe you were too.

What is an initial Coin offering?

An ICO is hard to define. An IPO is an Initial Public Offering where stock in Company ABC is offered to the public for the first time. In a similar manner, the ICO is a way for an enterprise to raise money, and they do this by selling their particular brand of cryptocurrency. The general advice for most investors is to shy away from the IPO for 2 reasons:

- If the enterprise had such a good start, private ownership could take it pretty far by itself without the IPO.

- There is often a large-ish drop in stock price just after an IPO. The ICO seems to work in a similar manner.

At the end of the day, I must admit that some people have made millions of dollars on the ICO. But, this small herd of unicorns is vastly outnumbered by the mass of humanity who were taken in by slick marketing, and these very optimistic valuations, which are generally unregulated.

How does an ICO work?

Most often, the advisory committee of the entity offering the ICO will issue a white paper (like a special report) which lays out how the ICO is going to be undertaken.

| Question answered | Comment |

| What is the purpose of the project? | Each ICO should have a real reason behind it, otherwise fraud is a real concern. |

| Upon completion, what need will the project fulfill? | Related to the question above, will the completed project satisfy a real need in the community. |

| How much money the project needs? | If the ICO does not raise enough revenue, funds may be returned to the investors. |

| How many of the virtual tokens will the founders retain? | This is important as a measure of how much confidence the founders have in the project, and how much control they will have over the valuation of the coin. |

| What types of payment will be accepted? | Perhaps only USD will be allowed, perhaps Bitcoin or another cryptocurrency will be the only allowed medium of exchange. |

| How long will the ICO run? | The ICO must have a definite end date to determine if funds need to be refunded, if unsuccessful. |

| How will valuation be structured? | Three options here: Static supply and static price. Static supply and dynamic price. Dynamic supply and static price. |

Who can start an ICO?

Anybody can start an ICO. So, it is really important to do a couple of things.

- Do your homeworkà Is the entity offering this new currency have the professional competence to complete the project? Read the whitepaper and look up the people mentioned as central to the entity. Do they have significant managerial experience? Do they have the technical know-how to get the project done? If not, please think twice about investing.

- Don’t be overwhelmed by celebrity endorsementsà This has already happened when several known actors and celebrities aligned themselves with currencies later determined to be a scam. Be careful.

- Look for transparency. If the terms are opaque, this could indicate a significant chance of fraud.

- Really look at the legal documents. Even if you’re not an attorney. If any of the terms give you pause, then you might not be cut out for this particular ICO.

- Look to see that the computer code has been audited by a 3rd party.

- Look carefully for typos, when examining the website. These could mean carelessness, which could lead to large losses later.

Is there ANY regulation at all?

Yes. The SEC can step in if an ICO is patently fraudulent. But, this is exceedingly rare, and the case has to be airtight. When there is no insider source or something similar, this airtight case cannot often be constructed.

Are there different types of ICO?

Yes, there are several different flavors of ICO. Generally, there are Public and Private ICOs. In a Private ICO, the company can limit the investors to “accredited investors”, who have a certain level of net worth, suggesting some kind of acumen with respect to investments. In a Public ICO, anybody can make an investment, at any value.

More specifically, if you are investigating this area of investment, you might happen upon the following terms:

| Term | What the heck does it mean? |

| Security Token Offering (STO) | The coin acts like a share of stock. These are heavily regulated by the SEC. |

| Interactive initial coin offering (IICO) | Each investor is limited as to the volume of tokens they can buy. |

| Initial supply Auction | Think of this as a reverse auction. The coin is offered first at a price that is WAY too high. Then, incrementally, the price is decreased until the coin begins selling. |

| Simple Agreement for Future Tokens (SAFT) | Think of these as rights to purchase tokens at a later date. |

| Airdrop | To open a new market, the company will sometimes give away some coins free. Think of this as part of the marketing. |

Are there advantages or disadvantages to investing in an ICO?

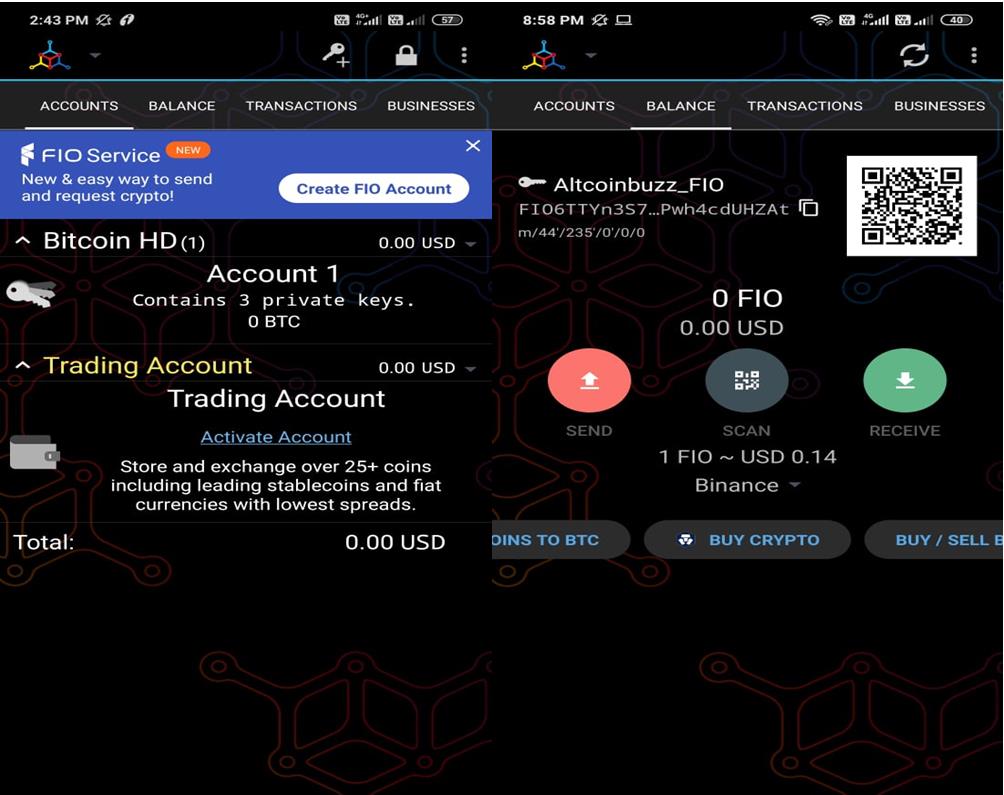

Yes, there are advantages. Chief among them is that you have significant opportunity to make a profit, assuming that that cryptocurrency appreciates. Also, IPOs are known to be very difficult to find or take advantage of, for the common investor. In comparison, anybody with an Ethereum wallet can participate in an ICO. For the company, this is an efficient way to raise a lot of money quickly.

And, yes, there are disadvantages as well. First, cryptocurrencies often disappear completely when projects go wrong. So, “high volatility” seems to be an under-statement of some degree. Related, since there is so little regulation, scams in this area are legion.

The Verdict

ICOs appear to be a huge gamble. On one hand, you might hit a base-clearing grand slam. On the other hand, you might carry the ball directly into the right-outfielder’s glove. This could lose you the game. I think the watchword is caution. Maybe, if you have a few percent of your investable n an ICO, this might be OK. (Dang, I really don’t like ending these sounding like my dad.) Be sure to understand your investment choices prior to making a decision.

REFERENCES

https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp

https://www.coindesk.com/learn/what-is-an-ico/

https://www.thebalance.com/what-is-initial-coin-offering-5182476

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.