Headline: Wallets without Walls

Date: 1/31/2022

Body: Quite recently, I have found a term called the “cryptocurrency” wallet. Sometimes called a “Bitcoin wallet” or something similar. Different from a normal wallet, often made from plastic or animal hide, this wallet is either entirely held on the Web or is held on something that resembles a USB stick. Different still, your transactions do not “live” on the USB stick, rather, your transactions “live” within the blockchain architecture; This is another way they differ from conventional wallets. The wallet comes with both private and public keys codes) that allows you to move your cryptocurrency around. The key is sometimes stored on paper, but this is rare, as it is not very secure. An app or web-based wallet utilizing 2-step encryption appears to be the ideal, in the spirit of cryptocurrency. The USB stick solution appears to be a compromise: Keep it locked away 90% of the time and take it out ONLY when you have a transaction to do.

Why are there BOTH Public and Private keys?

I was always curious about this and I found a nice explanation. The public key is there so that other people can send you cryptocurrency, whereas, the private key is there so that YOU can send cryptocurrency to others. As an example, now, if you know a person’s name, it’s a straightforward task to find their address, usually. (Remember phone books??) But, that address does not let you know that they hide a spare key in a fake rock that lives in the knot of a nearby tree. The address is the public key, the information about the fake rock is the private key.

What’s the difference between a wallet and an app?

The wallet allows you to make all normal transactions with your cryptocurrency. But, if you have the app, it allows you to securely save your private key also.

Are there different kinds of crypto wallets?

Yes, there are different types of wallets. In the main, though, the biggest distinction is between Hot storage wallets and cold storage wallets. Hot storage wallets are always attached to the internet, like a phone app. This is handy, but has some tradeoffs in security. The cold wallet, in contrast, are the USB-looking devices and you are required to physically keep them secure. You might also see references to custodial v. non-custodial wallets. In a non-custodial wallet, you are the one who has sole responsibility for your private key, so, you have to setup safety mechanisms to ensure that you don’t lose your private key. In a custodial wallet, Coinbase or other website holds your private keys. In addition, there are desktop wallets that sit on your desktop, and once again, security is your province here. Examples include Atomic Wallet, Bitcoin Core, BitPay and Exodus.

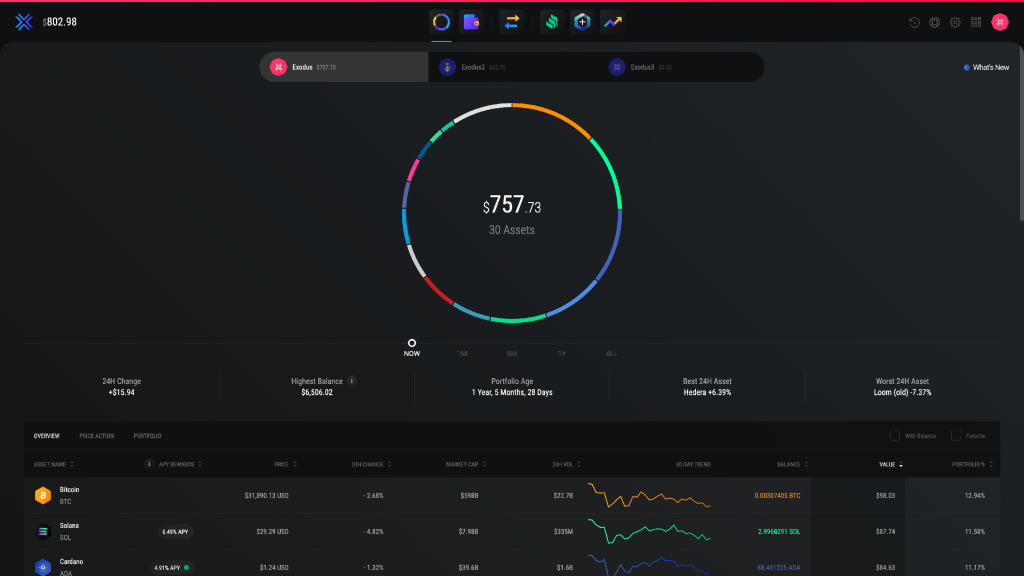

This is an Exodus wallet. Others tend to be similar.

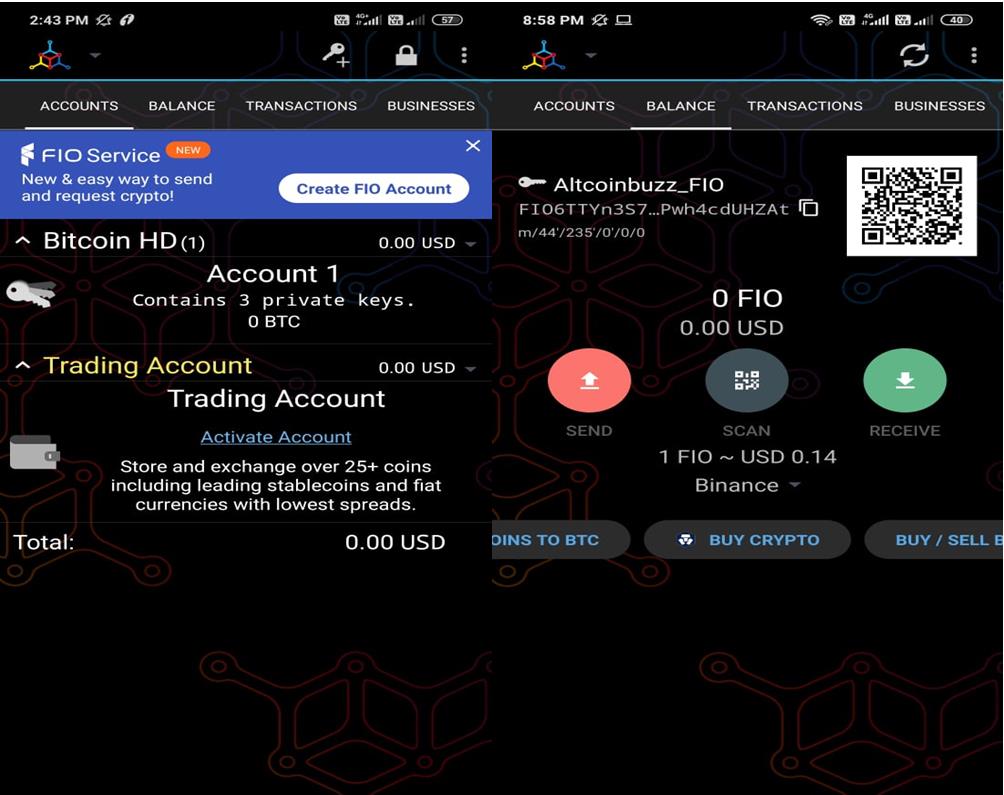

Mobile wallets are apps that reside on your smartphone and allow you to make payments in normal retail stores. Examples include Bitcoin Wallet, GreenAddress and Mycelium.

This is a Mycelium wallet. The other mobile wallets tend to be similar.

Examples of cold wallets are Trezor and Ledger.

This is a Ledger wallet. The other cold wallets look quite similar.

Which bitcoin wallet is best for you?

The answer to this question depends upon how you use cryptocurrency. Most experts seem to suggest that you keep a little in a hot wallet or 2 to pay for some things, and the majority of your cryptocurrency assets locked up in a cold wallet. This is because the cold wallets (i.e. hardware) tend to be more secure. I would recommend a hardware wallet, and to my research, they can be obtained for less than $200. This is a very sound investment. The wallet itself is usually free but transactions involving your cryptocurrency may cost a bit.

When you purchase and setup a Bitcoin wallet, the software will usually develop a “seed phrase.” This phrase is a key component of your private key and can be utilized to get to your Bitcoin in case of technical foul-ups. Guard this seed phrase CAREFULLY!!

Bitcoin Wallet Security Tips

It seems responsible to tell you that all is not well in crypto-town. There are bad actors, and phishing scams are rampant. There are even some scammers who have setup sites that look and feel like genuine wallets and are not. So, before we wind down, a few tips seem to be in line (or online, as the case may be.)

- Some wallets have special functions and features that are perfect for certain users. For instance, Coinbase, a cryptocurrency exchange platform, offers a Bitcoin wallet that has a user-friendly interface that makes it easy for new investors. Trezor sells hardware Bitcoin wallets that are known for their high level of security. Ledger also makes hardware Bitcoin wallets that have stainless steel covers, making them extremely durable for users expecting a bumpy ride. Exodus is a Bitcoin wallet that is optimized for desktop usage. For more advanced cryptocurrency users, Mycelium offers a mobile Bitcoin wallet that provides free cold storage.

- Consider a custodial wallet, such as Coinbase. Think of them as a Bank. When you deposit funds, these don’t go into your account, rather it goes to the general Bank assets, and the Bank now has an equal value obligation to you for the funds. But, you can bet your bottom dollar that the Bank has a better vault than your locked drawer at home. Same thing with the Coinbase wallet.

- Remember the old saw, If it seems too good to be true, it probably is. Buyer be Aware.

- If your exchange uses 2-factor authentication, that is good. But, if one of the factors is Text, be aware that some crooks can spoof your SMS signal that is the architecture of the Text feature. Consider adding some logical barrier (like a passphrase) to use the SMS architecture. (I also saw mentions of a hardware component called a Yubikey. It is a USB device that plugs into your device.

- Use a cold wallet for the majority of your cryptocurrency holdings. When analyzing the hacks that have been successful, the vast majority have been from hot wallets.

- Avoid using Public Wi-Fi, and consider adding a VPN at home for added protection.

- Have a strong firewall on your personal device at home, and keep your anti-virus software up to date.

- Change your passwords Regularly. When you do, be sure to use strong passwords. (e.g. capital and lower-case letters, numbers and special characters.)

The Verdict

Setting up a wallet and getting into the cryptocurrency markets can be scary. There is a whole new vocabulary to learn, and a whole new “commonsense” to obtain. But, with planning and a modicum of research, it can be done safely. Now all that you have to worry about is that the organization offering that currency doesn’t disappear. Once again, Buyer, Beware.

REFERENCES

https://www.nerdwallet.com/article/investing/best-bitcoin-cryptocurrency-wallet

https://www.coinbase.com/learn/crypto-basics/what-is-a-crypto-wallet

https://www.investopedia.com/terms/b/bitcoin-wallet.asp

https://money.usnews.com/investing/term/bitcoin-wallet

https://www.cnbc.com/2021/06/11/tips-to-help-keep-your-crypto-wallet-secure.html

https://cisomag.eccouncil.org/cryptocurrency-wallet-security/

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.