Ripples Can Be Felt

Headline: What is up with Ripple and their litigation with the SEC? Are there lessons to learn?

Date: 9/5/2022

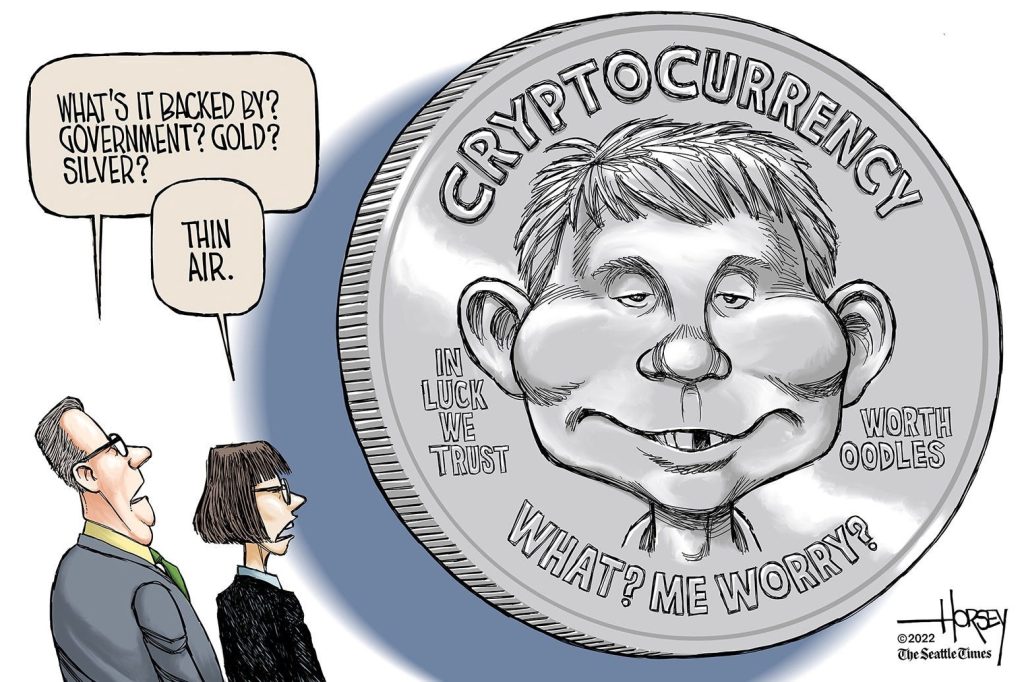

Body: Think promotions and commercials for financial services are bad now? Back before the Securities Acts of 1933 and 1934, things were REALLY bad within the financial markets. Without fear, mischievous and outright fraudulent pitchmen would be hawking their “can’t miss” investment opportunities. Well, with the advent of cryptocurrency, the past is repeating itself, or at least rhyming the new lyrics with the old ones. Scams abound, and projects that are semi-fraudulent are legion. Add to this mix, the natural back-biting and scrambling behaviors that are part and parcel of Federal budgeting, and it seems that successfully prosecuting these criminals is a budgetary bloodsport. One of the recent actions was brought by the SEC. In this move, the SEC is asserting that Ripple Labs perpetrated a $1.3 Billion fraud when they floated an unregistered security.

No, don’t leave!! This one is really interesting, I swear. OK. The complaint alleges that the XRP sold (the digital asset on offer) was a security that they sold without validly applying for or receiving an exemption to registration requirements. Now, this one seems most interesting because the majority of the digital assets that were distributed were in exchange for services rendered ,like market making. Said one SEC official, “”Issuers seeking the benefits of a public offering, including access to retail investors, broad distribution and a secondary trading market, must comply with the federal securities laws that require registration of offerings unless an exemption from registration applies,” said Stephanie Avakian, Director of the SEC’s Enforcement Division. “We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP and Ripple’s business and other important long-standing protections that are fundamental to our robust public market system.” This is interesting because the 1933 and 1934 Acts were not passed to disallow the selling of certain securities, rather, they were passed to ensure that potential investors had enough access to information to do their own due diligence research into the offering.

The’ Issue seems to hinge upon whether or not the XRP qualifies as a security. Now, here’s the Law & Order bit: there is a smoking gun memo wherein the SEC officials discuss whether XRP is a security or not, and apparently the SEC does not want to turn this over to Ripple in the discovery phase of the trial. (To me, not a lawyer, Ripple must have the scent of blood in their nose and this memo is likely red meat.) It seems that the SEC is trying to exclude all memos like this, but the judge has decided to shield only some of these documents from discovery. Said Ripple’s defense counsel, “We’re pleased with the Court’s order, which grants Ripple access to important documents that the SEC was withholding. We will continue to aggressively defend this case – and we remain optimistic that resolution of this case will provide much needed clarity to the industry,” Ripple General Counsel Stu Alderoty. One of the documents sought is a draft of a speech by an SEC official, wherein he opines that ETH is not a security. This would provide excellent evidence that XRP is not a security either.

Why go after Ripple?’

There are hundreds of other cryptocurrency related schemes, why go after Ripple? The answer is three-fold:

- The market capitalization is quite high

- Their parent company has agreements in place with many central banks of other countries.

- They have developed DLT which will allow for much faster transactions and clearing.

- They issued XRP in proportions in excess of the Howey test, and therefore, they are presumed to be securities.

- Ripple was already taken to court by some of its’ investors.

The Verdict

Security? Not a security, who cares? I get your point of view, really I do. But this is important because this has ramifications far beyond Ripple. There is a question of where and how this digital asset can be advertised. How should it be taxed? This is a VERY serious when it comes to making money with cryptocurrency. Additionally, the outcome could possibly lend some much needed stability to the pricing of such digital assets. If pricing were more stable, it makes it much more possible that larger pension funds and institutional investors will get involved with digital assets and this would lend some excellent evidence of confidence in digital currencies, and might encourage others to get started in digital currencies.

REFERENCES

https://www.sec.gov/news/press-release/2020-338

https://www.investopedia.com/xrp-loses-support-as-sec-files-case-against-ripple-5093766

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.