Headline: “Proof of Work” v. Proof of Stake

Date:2/14/2022

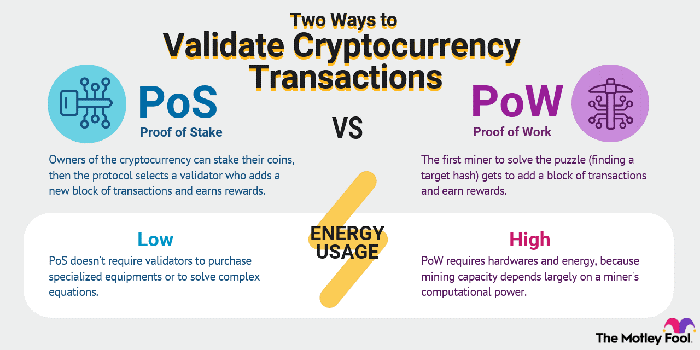

Body: Key to any cryptocurrency is the ability to earn new coin in exchange for validating transactions. For this effort, the investor is compensated in the same currency. To determine the level of compensation, one of 2 approaches seem to be used; Either “Proof of Work” or “Proof of Stake.” This process is also known as a way to negotiate their way to consensus.

What is “Proof of Work?”

In a Proof of Work paradigm, the individual servers and server farms compete to solve complex computational problems. (Please note that this approach uses a tremendous amount of electricity. To give you an idea, most experts estimate that these miners spend 60-80% of their revenue earned on electrical power.) The first one to get to a solution is awarded a block of transactions to validate.

An example involving the Bitcoin system follows; 5 people (a.k.a. nodes or miners) are given a difficult computational task. The first one solves it, and the solution is accepted by 3 other coders, the solution is written on the community whiteboard (a.k.a. Blockchain) and then coder #1 gets an award of cryptocurrency for being first with a solution.

What is “Proof of Stake?”

In this system, the investor “stakes” some of their cryptocurrency, and in return gets the right to validate a block of transactions. At any point, you can unstake your crypto coins, but, while staked, if a person validates an inaccurate transaction, they permanently lose a piece of their cryptocurrency as a penalty.

An example follows: Investor A buys Cardano, a cryptocurrency that uses proof of stake. If they stake some of their coins, they could be chosen to be a validator of a block of transactions, and when they finish validating the block, they are rewarded with more cryptocurrency of the same type. Note that under this system, the more coins that are staked, the more likely it is that they will be chosen to be a validator. Not surprisingly, there are now staking pools, pods of investors, when several investors put their money together to increase their chance of earning money from mining. The amount staked is certainly important, but there are often other attributes considered such as time that the person has been a validator and there is an element of randomness.

Can you give me some examples of cryptocurrencies that use proof of stake?

| Variety of Cryptocurrency | Description |

| Cardano | Research-driven blockchain platform that emphasizes security and sustainability. |

| Tezos (CRYPTO:XTZ) | Programmable blockchain designed with an on-chain upgrade mechanism for adaptability. |

| Algorand (CRYPTO:ALGO) | Uses a 2-tier blockchain structure to offer processing speeds of 1,000 transactions per second. |

What are the Pros and Cons of the Proof of Stake paradigm?

| Pros | |

| Fast transaction times | Because the computations are simpler, POS can support faster transaction times, and is more scalable. |

| Low network fees | The staking allows for very low fees. |

| Energy efficient | Per many resources, even if you have a server farm doing Proof of Work, you are likely to spend 80% of what you earn on electricity. |

| Cons | |

| 51% security risk | If one person or group comes to obtain 51% or more of the network, they control the entire network. |

Anything really new on the RADAR screen for this kind of crypto?

Ethereum, in its original package was a Proof of Work system. There is a project being worked on, called Ethereum 2.0, which will be a Proof of Stake consensus model. This effort is being supported by the Ethereum Foundation in Switzerland, which is bolstered by nearly $1 Billion in Ethereum coins. “There’s hundreds of people that work on this project,” said Ryan, who is one of the few researchers employed by the foundation. “The EF certainly plays a kind of coordination role, and has tried to help facilitate and keep things moving. But I would say it’s certainly not centralized.” When the change is made, electricity demands are expected to decrease greatly.

The Verdict

Proof of Stake seems to be an evolution of Proof of Work. The whole goal of cryptocurrency is decentralization, so, if the Power Company takes the place of the Federal Reserve, the goal is defeated. But, Proof of Stake allows for much lower levels of power usage, and seems in the mold of what the DeFi systems are set up for in the first place. Now, should the “regular” investor sink money into this environment? I think with investigation, investors can get a fair deal, but it seems even more important that the investor have a well-defined exit plan. This seems to be the consensus, anyway.

REFERENCES

https://www.thebalance.com/proof-of-stake-pos-5196135

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.