Headline: Is the valuation of cryptocurrencies correlated to the performance of the stock market?

Date: 3/23/2022

Body: Who cares? Why do we care if the value of cryptocurrency is correlated with the performance of the stock market? Cynic. Well, actually, a good question. Typically, we are looking at cryptocurrency to serve as a diversifying agent for our portfolio. Assuming that it’s a largely stock-based portfolio (often it is) then our other investment should ideally not do really badly when our stock portfolio is tanking too. This is why we should care. If your investment is not correlated with the performance of the stock market, you can sleep a little better knowing that most likely as one investment or a few go down in value, the other ones are going up or staying even. But, if they are highly correlated, then adding cryptocurrency does not achieve the diversification you are looking for.

OK, sorry for the flashback to Statistics…

Just as a reminder, if 2 things are uncorrelated (perfectly) the correlation will have a value of 0. If there is a perfect positive correlation (as one increases in value, so does the other) the value will be 1. If there is a perfect negative correlation (as one increases in value 10%, the other decreases in value 10%) the value is -1. Any other relationship between the two valuations slip somewhere betwixt the 1.00 and -1.00 values. The value of bitcoin seems to have a slight correlation with the stock market (the value appears to be from .2 to .3 based upon what index is used.) That being said, sometimes when there is a huge loss in stocks, there is also a huge loss in value for cryptocurrencies. Why does there seem to be a tie binding the two, and how can I either take advantage of it or account for it?

What Do Analysts Say?

Good analysts don’t say much… ooh… sorry, wrong analysts. There are 2 main hypotheses for this seeming correlation. And, yes, they do interact with one another.

- Some analysts suggest that people get into stocks and cryptocurrencies for similar reasons: Namely, they wish to add some risk to their portfolio so that their chance of reward increases. For this reason, as some people adjust their risk up with stocks, others adjust their risk with cryptocurrencies, often at similar timescales. For this reason, there appears to be a correlation.

- There is a large consultancy called Datatrek, and their analysts seem to suggest that investing in cryptocurrency is being normalized. Per the analysts, “Since investors have only one brain to process risk, they will make similar decisions about cryptocurrencies and stocks when they see price volatility in the latter.” So, when the butterflies in their stomachs become too great within the stock market, they also pull their investment in cryptocurrency.

What is likely to happen down the road?

OK, we have to step back a bit here. Per the Tabb Group (another consultancy) institutional investors (think pension funds etc.) represent up to 88% of trading volumes, and right now, they are reticent to jump into cryptocurrency. But don’t be fooled: They probably will (and my guess is soon) and when they do, they will jump in with both feet. This means, for little investors like us, that the volatility will likely dampen, and that’s probably good.

Just last week, President Joe Biden signed an Executive Order, instructing several government agencies to begin conversations (and publish reports) related to how they are likely to be best involved in the cryptocurrency markets. This added regulation will likely help to dampen volatility. President Biden’s executive order on crypto regulation is a “huge milestone” for crypto and further enhances “the legitimacy and long-term outlook of the space, which bodes well for Bitcoin, which is still king, at least for now,” says Brian Goldblatt, CPA and industry leader of digital assets at Prager Metis.

If a picture paints ten thousand words…

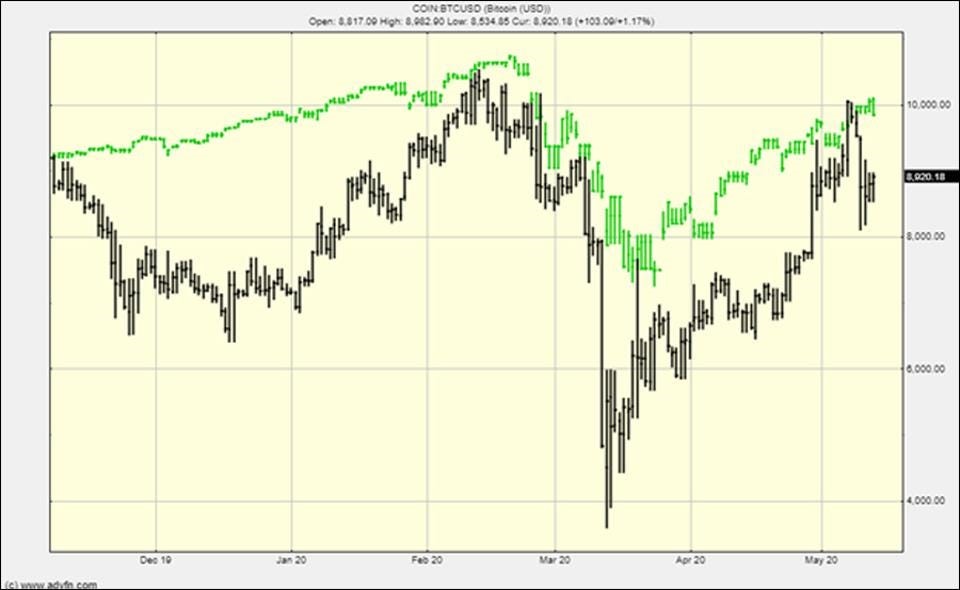

Bitcoin is meant to be an uncorrelated asset and this is/was a positive. However, it is clear that right now bitcoin correlates with stocks very closely:

Bitcoin and stocks are moving in sync

CREDIT: ADVFN

From just a cursory inspection of this graph, it is pretty clear that the value of these two asset classes can be highly correlated over the short term. I suspect this is likely due to emotions. (Behavioral finance is a fascinating area of study.) It does seem important to note, however, that this correlation seems to weaken over the longer span of time.

The Verdict

Small investors (like us) should probably limit their holdings in cryptocurrencies to 1% to 3% of their portfolio, since it could “lose a lot of its value in a short amount of time,” says Alex Chalekian, CEO of Lake Avenue Financial in Pasadena, California. If you want to get a punch from cryptocurrency without being kicked by it, you might want to consider a different approach. There are several ETFs that invest in Bitcoin and other cryptocurrencies. These ETFs are easy to purchase and probably will do better than you buying random cryptocurrencies. Alternatively, you could invest in stocks that make extensive use of cryptocurrencies (e.g. Coinbase Global, Paypal and MicroStrategy.) In this way, you benefit from the aggressive earnings of the crypto world, but, you are not held prisoner to the craziness at full volume. Investors need to view Bitcoin as a “very good vehicle for someone who is truly a speculator – either a bull or a bear,” says Robert Johnson, a finance professor at Creighton University. BTC could rise exponentially in value, collapse again or do both repeatedly. Investors can only speculate on the future price of Bitcoin because it has no intrinsic value, unlike gold, he says.

Whatever approach you choose, all I have to say is, “May the forks be with you…”

REFERENCES

https://www.investopedia.com/news/are-bitcoin-price-and-equity-markets-returns-correlated/

https://money.usnews.com/investing/cryptocurrency/articles/is-bitcoin-worth-investing-in

Editor’s Note: Please note that the information contained herein is meant only for general education: This should not be construed as Tax Advice. Personal attributes could make a material difference in the advice given, so, before taking action, please consult your tax advisor or CPA.